Buyer's Guide

Buying a home is one of the most important steps in life, whether it's to purchase your first home, invest, or move to a new space. However, this process can seem challenging, filled with financial details and strategic decisions.

This guide was created to help you understand every stage of the home-buying journey. Here, you will find essential information, practical tips, and guidance to make safe and well-informed decisions.

Whether you're a first-time buyer or an experienced real estate investor, this guide will provide the support you need to make your purchase smooth and successful. Let's get started! 🚀

Step #1: Hire a Realtor

How We Provide Value:

1. Explain steps and process in advance.

2. Guidance and support throughout the entire process.

3. Help with the search for your home: Immediate auto-emails of newly available properties, MLS searches, extensive contact lists to find pre-marketed properties, and more!

4. Advise you on market conditions, pricing, negotiating tips, financing, etc.

5. Advocate for you by negotiating with Sellers, Lenders, Appraisers, Inspectors, Contractors, Insurers, Title and Company.

6. Paperwork and Legalities: Real estate transactions involve extensive paperwork and legal documentation. Realtors are familiar with the necessary contracts, disclosures, and local regulations.

7. Manage your transaction- mortgage, insurances, inspections, repairs, warranties, and other important details.

8. Time and Convenience: Buying or selling a property can be time-consuming. Realtors can save you time by handling tasks such as property searches, scheduling showings, coordinating inspections, and managing communication with other parties involved.

9. Extensive list of contractors to refer as needed.

10. Attend final inspection and closing to represent your interests.

Step #2: Finances

1. Assess your Financial Situation:

Consider factors such as your monthly income, savings, investments, and any potential future financial changes.

2. Calculate Your Down Payment:

Determine how much you can afford to put down as a down payment.

Remember that a larger down payment may result in lower monthly

mortgage payments and potentially better loan terms.

3. Factor in Additional Costs:

Beyond the purchase price and down payment, consider other costs

associated with buying a home. These may include closing costs, home

inspections, property taxes, homeowners insurance, and potential

renovations or repairs.

4. Consider Mortgage Affordability:

Use online mortgage calculators or consult with a mortgage professional to estimate how much you can borrow and what your monthly mortgage payments might be.

Take into account factors such as interest rates, loan terms, and any potential changes in your financial situation.

5. Seek Professional Guidance:

Consulting with a financial advisor or mortgage specialist can provide

valuable insights and help you determine a budget that aligns with your

financial goals and circumstances.

The Importance of a Pre-Approval

1.UNDERSTANDING YOUR BUDGET

A preapproval helps you determine the maximum loan amount you can qualify for, giving you a clear understanding of your budget. This allows you to focus your home search on properties within your price range, saving time and effort by avoiding homes that are outside of your financial capabilities.

2. INCREASED NEGOTIATION POWER

Sellers often prioritize offers from preapproved buyers because they demonstrate financial readiness and seriousness. Having a preapproval gives you a competitive edge in a competitive real estate market, increasing your chances of having your offer accepted.

3. EARLY IDENTIFICATION OF ISSUES

During the preapproval process, the lender reviews your financial information and credit history. If there are any red flags or issues that could impact your ability to secure a loan, they can be identified early on. This gives you an opportunity to address any problems, improve your credit score, or make necessary financial adjustments before proceeding with a home purchase.

A mortgage preapproval is a process where a lender evaluates your financial

information to determine the maximum loan amount you can borrow and the

interest rate you may qualify for. It provides you with an estimate of how much you can afford to spend on a home and demonstrates to sellers that you are a serious buyer.

Step #3: Exploring the Market

- Identify your wants, needs, and specifications in a home.

- Once we identify your home wants and needs, we will send you homes that fit the criteria.

- Schedule time to tour homes and neighborhoods.

- Finding the right home is important. We will always ask for

honest feedback after every home tour to ensure we find the right fit.

- Be sure to do your research on local crime, school districts, demographics and other local details that may be important to you. A Realtor is prohibited from giving personal opinions on these topics.

Step #4: Negotiating Your Terms

Submitting An Offer

When you find a home you want to purchase, you'll work with your real estate agent to submit an offer to the seller. The seller will review your offer and may accept it, reject it, or counteroffer. Negotiations may take place until both parties agree on the terms of the purchase.

Factors we consider when writing an offer:

- Sales price

- Comparative Market Analysis (CMA)

- Earnest Money

- Financing Terms

- Inspections

- Closing Date

- Seller Contribution

Step #5: Inspections

We highly recommend that you have a professional home inspector conduct a thorough inspection- resale or new construction. The inspection is intended to be informational to the buyers and provide report on major damage or serious problems that require repair if applicable.

THE INSPECTION WILL INCLUDE THE FOLLOWING:

- Structural components: Foundation, roof, walls, floor, and ceilings Exterior features: Siding and exterior finishes, windows and doors, driveway and walkways

- Appliances

- Plumbing System

- Electrical System

- HVAC Systems: Heating/Cooling Systems and Ventilation

- Roof and Attic (if accessible)

- Basement and crawl spaces

Step #6: Submit Loan to Lender

- Property Inspection

- Comparative Market Analysis

- Property Characteristics

- Location

- Market Conditions

- Additional Factors unique to the property (i.e easements and encroachments).

Step #8: Prepare to Close

Loan Commitment: After a file has been fully underwritten and all of the conditions are satisfactorily met, a final loan approval will be issued. This is known as "Clear to Close."

Homeowners Insurance: Competitive rates; Impacts your monthly payment.

Title Company/Closing Attorney: Manages all parties in a transaction; Leverage for getting problem solved; Closing on time; Protecting your interests; Clearing the title and transferring ownership of property to you.

The Final Details: All documents to the lender in a timely manner; Appraisal; Lender repairs where applicable; Closing & Settlement review; Transfer of utilities; Moving into your new home!

Step #9: Closing Day!

Congratulations! You've worked so hard to get to this day... CLOSING DAY! Settlement day, also known as closing day, is a significant milestone in the process of buying or selling a property. It is the day when the legal ownership of the property is transferred from the seller to the buyer, and the agreed-upon terms and conditions of the sale are finalized. Here's a breakdown of what typically happens on settlement day:

FINAL WALK THROUGH

A final walkthrough is a crucial step that typically occurs shortly before the closing. It provides the buyer with an opportunity to inspect the property before taking ownership. The purpose of the final walkthrough is to ensure that the property's condition aligns with the agreed-upon terms of the purchase.

WHO WILL BE THERE?

You, the buyer(s); Seller(s); Buyer's agent; Listing agent; Closing attorney- the person representing the title company and responsible for ensuring the title is transferred to you.

WHAT WILL YOU NEED?

A valid government issued ID and a second form of ID; Wire closing funds 24 hours prior to closing; Your mortgage officer will tell you the final amount three days prior to closing.

✅ Home Closing Checklist for Buyers

✔ Inspect the property

✔ Provide insurance to the lender

✔ Get homeowners insurance – Make sure to compare rates!

✔ Provide the lender with all required documents and information on time

✔ Review Closing Disclosure (3 days prior to closing)

✔ Request closing funds from your financial institution

✔ DO NOT wire any funds without direct wiring information from the escrow officer

✔ Bring a government-issued ID and a secondary form of ID

✔ Conduct the final walk-through

✔ Transfer utilities into your name, effective on closing day

✔ Get the keys and enjoy your new home! 🏡🎉

This checklist serves as a step-by-step guide to key milestones and what to expect when closing on a house as a buyer. ✅

Got questions? Get in touch!

Categories

Recent Posts

GET MORE INFORMATION

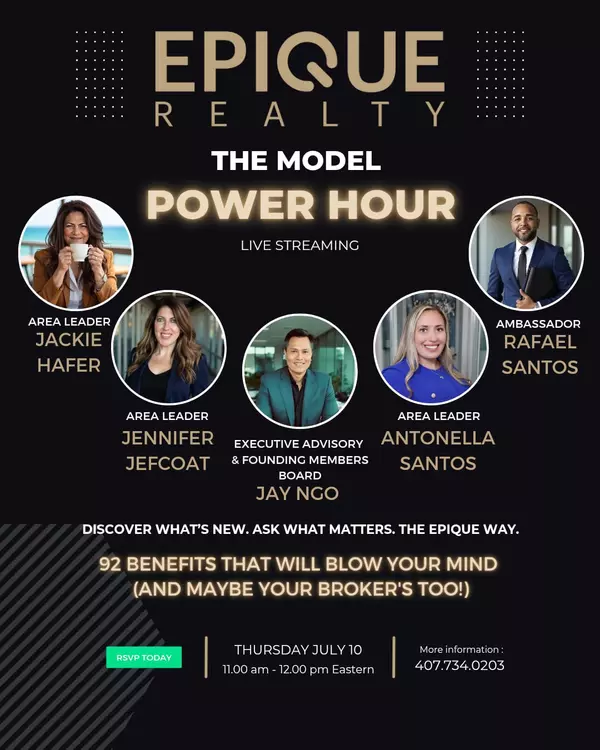

Realtor Area Leader & Licensed Loan Officer | License ID: 3424579

+1(407) 734-0203 | santos@epique.me