How Self-Employed Buyers Can Qualify for a Mortgage in Florida

Why This Matters

If you're self-employed and dreaming of owning a home in beautiful Central Florida, you're not alone. With warm weather, proximity to beaches, top-rated schools, and a growing economy, areas like Volusia County and Deltona are prime locations for entrepreneurs, creatives, and business owners alike.

But while self-employment comes with freedom and flexibility, it can make mortgage approval feel a little more complicated. The good news? With the right steps, buying a home as a self-employed buyer in Florida is absolutely within reach.

📋 What Lenders Look for When You're Self-Employed

Mortgage lenders aren’t just looking at how much you make—they want proof of consistent, reliable income. Here’s what they typically require:

-

2+ years of self-employment history

-

Tax returns (personal and business, often two years)

-

Profit & Loss statements (P&L)

-

Bank statements (personal and business)

-

Credit score – 620 minimum for conventional loans; FHA options available at 580

-

DTI (Debt-to-Income) ratio – ideally under 43%, though 50% may be accepted in some cases

💡 Tip: The more organized and clean your financial documents are, the stronger your application.

🏦 Mortgage Programs That Work for Self-Employed Buyers

1. Bank Statement Loans

Perfect if you deduct heavily on your taxes and your net income appears lower than what you actually earn. These loans use 12–24 months of bank statements instead of tax returns.

2. 1099-Only Loans

Tailored for independent contractors and gig workers. Lenders may accept 90–100% of your 1099 income without traditional tax docs.

3. One-Year Self-Employed Program

Some lenders offer flexibility for borrowers with just one year of self-employment history—especially if you have prior experience in the same field.

4. FHA & Conventional Loans with Co-Signer

Adding a co-borrower with a W-2 income (like a spouse or family member) can boost your loan eligibility.

5. Asset Depletion & Non-QM Loans

If you have significant savings or investments, these loans calculate your income based on your assets—great for high-net-worth buyers with fluctuating income.

🛠️ Smart Tips to Boost Your Approval Chances

Here’s how to make your mortgage application stronger:

-

✅ Separate business and personal finances

-

✅ Work with a CPA to produce profit & loss statements

-

✅ Improve your credit score to 680+

-

✅ Pay down existing debt to lower your DTI

-

✅ Save up for a solid down payment (at least 10–20%)

-

✅ Keep consistent deposits in your bank statements

-

✅ Avoid large expenses or credit applications before closing

🌴 Why Central Florida Is a Great Place to Buy

Living in Central Florida isn’t just about sunshine—it’s a smart investment. Here’s why:

-

🏖 Proximity to beaches, like Daytona and New Smyrna

-

🎢 Access to attractions like Disney, Universal, and SeaWorld

-

🏡 Beautiful neighborhoods in Deltona, DeLand, and Port Orange

-

👨👩👧👦 Top-rated schools and parks like Blue Spring State Park

-

🚀 A growing economy with remote work and tech-friendly jobs

🔄 The Self-Employed Mortgage Process (Step-by-Step)

-

Gather your documents – tax returns, bank statements, 1099s, P&Ls

-

Get pre-approved – work with a trusted local mortgage lender

-

Choose the best loan program for your income type

-

Start house hunting in Central Florida hot spots

-

Close and celebrate your new Florida lifestyle!

✅ Conclusion: Yes, You Can Buy a Home While Self-Employed

If you're a freelancer, small business owner, or entrepreneur in Deltona or Volusia County, getting approved for a mortgage is 100% possible—with the right preparation and a trusted team by your side.

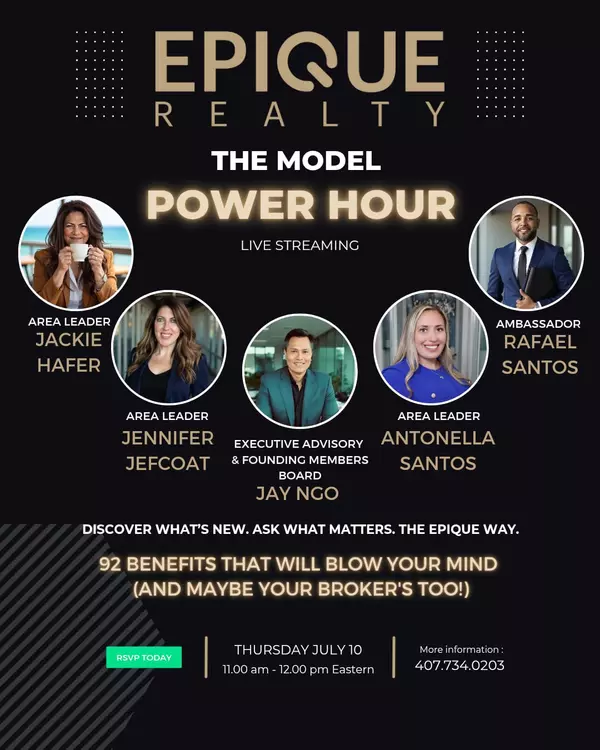

The Santos Home Team specializes in helping self-employed buyers like you navigate the process with confidence. We'll connect you with reliable lenders, help you prepare the right documents, and guide you every step of the way.

📞 Ready to Buy in Central Florida? Let’s Chat!

Contact the Santos Home Team today to get started:

📞 407-734-0203

✉ santos@epique.me

🌐 santoshometeamflorida.com

Categories

Recent Posts

GET MORE INFORMATION

Realtor Area Leader & Licensed Loan Officer | License ID: 3424579

+1(407) 734-0203 | santos@epique.me