Common Reasons Loans Get Denied & How to Prevent It: A Guide for Homebuyers

Buying a home is an exciting milestone, but the mortgage approval process can sometimes be challenging. Understanding why loans get denied and how to prevent these setbacks can help you navigate the homebuying journey smoothly. This guide will explore the most common reasons loans get denied and provide actionable steps to improve your chances of approval.

1. Low Credit Score

Why It Happens:

Lenders use credit scores to assess your financial reliability. A low score may indicate missed payments, high debt levels, or other risk factors.

How to Prevent It:

-

Check your credit report and dispute any errors before applying.

-

Pay down outstanding debts and make all payments on time.

-

Avoid opening new credit accounts before applying for a mortgage.

2. High Debt-to-Income (DTI) Ratio

Why It Happens:

Your DTI ratio measures how much of your income goes toward paying debts. A high ratio signals that you may struggle to manage additional mortgage payments.

How to Prevent It:

-

Pay off existing debts to lower your ratio.

-

Increase your income by taking on additional work or negotiating a raise.

-

Consider applying with a co-borrower to strengthen your financial profile.

3. Insufficient Income or Employment History

Why It Happens:

Lenders look for stable income and employment history to ensure you can afford mortgage payments. Gaps in employment or inconsistent earnings can raise concerns.

How to Prevent It:

-

Maintain steady employment for at least two years before applying.

-

Provide additional income documentation, such as tax returns and pay stubs.

-

If self-employed, work with a lender familiar with non-traditional income verification.

4. Low Down Payment or Insufficient Cash Reserves

Why It Happens:

Lenders require a minimum down payment and may ask for cash reserves to cover future mortgage payments in case of financial hardship.

How to Prevent It:

-

Save early and budget for your down payment and closing costs.

-

Explore down payment assistance programs and grants.

-

Look into loan programs that allow lower down payments.

5. Issues with the Property Appraisal

Why It Happens:

Lenders require an appraisal to confirm the home’s value. If the appraisal is lower than the agreed price, the loan may be denied.

How to Prevent It:

-

Research comparable sales before making an offer.

-

Negotiate with the seller if the appraisal comes in low.

-

Request a second appraisal if discrepancies exist.

6. Errors or Fraud in the Application

Why It Happens:

Providing inaccurate or incomplete information, whether intentional or accidental, can lead to loan denial.

How to Prevent It:

-

Double-check all details before submitting your application.

-

Be honest about your income, debts, and financial history.

-

Work closely with your lender to ensure all paperwork is accurate.

7. Recent Large Financial Transactions

Why It Happens:

Lenders closely examine recent large purchases or deposits that could affect your financial stability.

How to Prevent It:

-

Avoid large purchases before closing, such as buying a car or taking on new debt.

-

Keep a paper trail for any significant deposits to verify their source.

Final Thoughts

Understanding why loans get denied can help you take proactive steps to improve your chances of approval. By preparing in advance and working closely with a trusted lender, you can successfully navigate the mortgage process and achieve your dream of homeownership.

If you're ready to take the next step, consult with a mortgage expert to discuss your financial situation and get personalized advice!

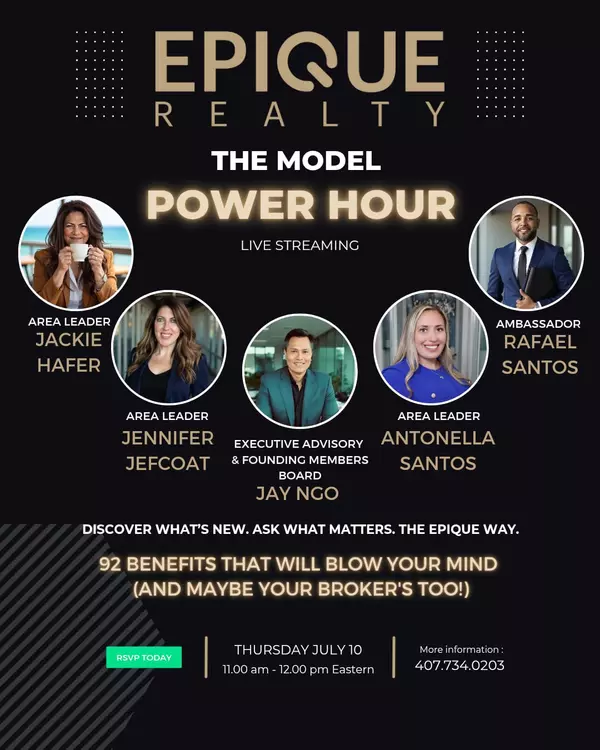

Rafael Santos

Mortgage Loan Originator

NMLS# 1826690

Email: rafael.santos@clearmortgage.com

Web: https://clearmortgage.com/rafael-santos

Categories

Recent Posts

GET MORE INFORMATION

Realtor Area Leader & Licensed Loan Officer | License ID: 3424579

+1(407) 734-0203 | santos@epique.me