DSCR Loans: A Powerful Financing Tool for Rental Property Investors

Investing in rental properties has long been a proven path to building long-term wealth and financial independence. However, traditional mortgage requirements, especially those requiring extensive income documentation, can sometimes become a stumbling block for investors—particularly for those managing multiple properties. Fortunately, there’s an alternative financing solution that’s specifically designed to help investors grow their rental portfolios without the hassle of traditional mortgage qualifications: Debt-Service Coverage Ratio (DSCR) loans.

In this post, we'll take a deep dive into what DSCR loans are, how they work, and why they’re a game changer for real estate investors in Florida and beyond. Whether you're a seasoned investor or just getting started, understanding how DSCR loans can benefit you is crucial to maximizing your investment strategy.

What is a DSCR Loan?

A Debt-Service Coverage Ratio (DSCR) loan is a type of mortgage product designed for real estate investors that focuses on the income generated by the rental property, rather than the borrower’s personal income. In other words, DSCR loans evaluate the ability of the property itself to generate enough cash flow to cover its own expenses—such as the mortgage payments, property taxes, insurance, and any applicable maintenance costs.

The DSCR ratio is calculated by dividing the net operating income (NOI) of the rental property by the total debt service (i.e., the mortgage payments). A ratio of 1.0 means the property generates just enough income to cover its debts. A DSCR ratio above 1.0 indicates the property earns more than enough to cover the mortgage, while a ratio below 1.0 suggests the property isn't generating sufficient income to meet its debt obligations.

Why DSCR Loans are Perfect for Rental Investors

DSCR loans offer unique benefits that make them especially attractive for rental property investors. Here’s a closer look at the main advantages:

1. No Personal Income Documentation Required

One of the most significant benefits of DSCR loans is that they don’t require you to submit personal income documentation, such as tax returns or W-2s. Traditional mortgages often require extensive documentation of your personal income, which can be problematic for investors who may have fluctuating income streams or prefer not to mix their personal finances with their investments.

With DSCR loans, lenders focus on the property’s cash flow—as long as the rental income covers the mortgage and other property expenses, your personal income situation is less of a concern.

2. Unlock Portfolio Growth Potential

For investors looking to rapidly scale their real estate portfolio, DSCR loans are ideal. Since the loan approval is based primarily on the income-generating potential of the property, DSCR loans enable you to leverage existing properties to acquire additional assets. This allows you to grow your portfolio faster than you could with traditional financing options, which may limit the number of mortgages or require significant income documentation.

By using the equity and rental income from your current investments, you can reinvest into more properties, expanding your wealth-building opportunities.

3. Flexible Loan Terms and Property Types

DSCR loans offer a great deal of flexibility, both in terms of the types of properties you can finance and the terms of the loan itself. With DSCR loans, investors can finance a wide range of properties, including:

- Single-family homes

- Multi-family buildings

- Townhomes

- Condos

- Mixed-use properties

This flexibility makes DSCR loans a versatile option for real estate investors, allowing them to tap into diverse property types and maximize rental income.

4. Competitive Interest Rates

Despite the lenient documentation requirements, DSCR loans still offer competitive interest rates. In fact, many investors find that DSCR loan rates are often comparable to those offered by traditional lenders. This means you can take advantage of easier qualifications while still securing a cost-effective loan, minimizing your overall financing costs.

5. Long-Term Financing Stability

DSCR loans often come with longer loan terms compared to traditional investment property loans, which typically range between 15 to 30 years. The long-term nature of DSCR loans provides more predictable monthly payments and financial stability, allowing you to manage your properties more efficiently and focus on growing your wealth.

How to Qualify for a DSCR Loan

While DSCR loans are more flexible than traditional loans, there are still some qualifications and factors lenders will consider. The most important factor is the property’s DSCR ratio—lenders typically look for properties with a DSCR ratio of at least 1.25, though some lenders may accept a lower ratio.

Here are other key factors lenders assess:

- Property’s location: Is it in a strong rental market with high demand?

- Property condition: Is the property in good shape, or will repairs and maintenance be needed?

- Rental income history: Is there a track record of stable rental income, or is it a newly acquired property?

- Investor’s creditworthiness: While personal income isn't a factor, lenders still review your credit score and financial history to assess overall risk.

Though DSCR loans don’t require personal income documentation, maintaining a healthy credit score (generally 620 or higher) will help you secure the best rates and terms.

Why DSCR Loans are Ideal for Florida Investors

Florida's booming real estate market and high demand for rental properties make DSCR loans especially beneficial for investors in the Sunshine State. Whether you're looking to invest in vacation rentals near the coast, single-family homes in Orlando, or multifamily properties in Miami, DSCR loans can help you scale your rental portfolio without the red tape of traditional financing.

Conclusion: Leverage DSCR Loans to Build Wealth

DSCR loans are an excellent tool for investors seeking flexible and efficient financing solutions for their rental properties. By focusing on the property’s income-generating potential rather than your personal income, DSCR loans make it easier to grow your portfolio, increase rental income, and build long-term wealth.

If you’re ready to expand your real estate investments, explore the opportunities DSCR loans provide. Contact me today to learn more about how DSCR loans can help you unlock your full investment potential.

https://clearmortgage.com/rafael-santos/

Categories

Recent Posts

GET MORE INFORMATION

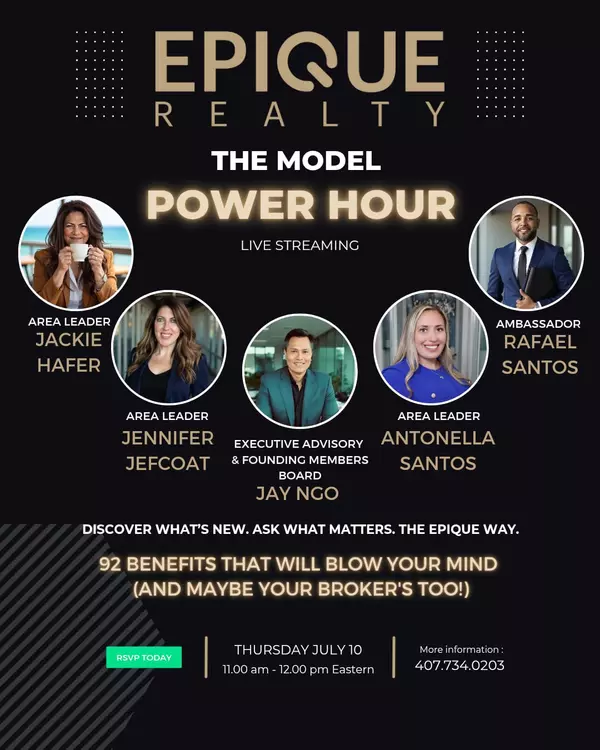

Realtor Area Leader & Licensed Loan Officer | License ID: 3424579

+1(407) 734-0203 | santos@epique.me