First-Time Home Buyers in Florida: Understanding Your Mortgage Options

Buying a home is one of the most significant decisions you'll make in your life. However, the process can feel overwhelming and confusing, especially for first-time buyers. I’ve helped many first-time homebuyers navigate mortgage loan options, so they can secure their dream homes with competitive rates and terms.

Our website is packed with resources to help you get started on your homebuying journey, including information on Florida down payment assistance programs, conventional loans with as little as 3% down, FHA loans with 3.5% down, and even VA loans that offer 100% financing for eligible veterans.

Start Early and Explore Your Options

It’s essential to start shopping for your mortgage early to familiarize yourself with the programs available for first-time homebuyers. Doing so will help you determine which loan best fits your needs, whether it’s a low down payment option or a government-backed loan with flexible terms.

Let’s take a look at some popular mortgage programs for first-time buyers:

1. Fannie Mae 97% LTV Conventional Mortgage Loan

This option is perfect for first-time homebuyers who may not have a large down payment saved but still want to benefit from the flexibility of a conventional loan.

Key Features:

- Credit scores as low as 620

- Down payments as low as 3%

- Mortgage insurance can be canceled once you reach 20% equity

- At least one borrower must be a first-time homebuyer (if the down payment is under 5%)

- 15- and 30-year fixed terms available

- Eligible for 1-4 unit properties, PUDs, condos, and manufactured homes

- 100% gift funds allowed for down payments

- No income limits

2. Fannie Mae HomeReady Loan Program

Designed for low- to moderate-income borrowers, the HomeReady mortgage offers flexible funding and lower mortgage insurance costs, making it an excellent choice for those facing financial challenges.

Borrower Benefits:

- Lower monthly payments due to reduced interest rates and mortgage insurance

- Down payment as low as 3% with flexible funding sources

- Cancellable mortgage insurance

- No reserves required

- Income limits set at 80% of the area median income (check eligibility using the AMI lookup tool)

3. Freddie Mac HomeOne Conventional Loan Program

The Freddie Mac HomeOne mortgage offers a low down payment option with no income or geographic restrictions, making it accessible to more first-time buyers.

Key Features:

- Credit scores as low as 620

- Down payments as low as 3%

- Mortgage insurance cancellable after 20% equity

- Available for 1-4 unit properties, PUDs, condos, and manufactured homes

- No income limits

- 100% gift funds allowed

4. VA Loans

If you’re an active-duty service member, veteran, or eligible spouse, the VA loan program is a fantastic option. VA loans provide up to 100% financing with no mortgage insurance, making homeownership more accessible for those who have served.

Program Highlights:

- Up to 100% financing

- No mortgage insurance required

- Credit scores as low as 540

- Available for both first-time buyers and repeat buyers

- Fixed-rate purchase and refinance options available

5. FHA Loans

Backed by the Federal Housing Administration, FHA loans are designed for low- to moderate-income borrowers. They offer flexible credit requirements, allowing for higher debt-to-income ratios and lower credit scores compared to conventional loans.

Key Features:

- 3.5% down payment

- Credit scores as low as 540 (with 10% down for scores below 580)

- Available for 1-4 unit properties, PUDs, and FHA-approved condos

6. Florida Down Payment Assistance Programs

Many first-time buyers in Florida can benefit from down payment assistance programs that help cover the initial costs of buying a home. The Florida Housing Finance Corporation offers programs like:

-

Florida Assist Mortgage Program (FL Assist): Up to $10,000 for FHA, VA, and USDA loans with a 0% interest rate. Payments are deferred until the home is sold, refinanced, or transferred.

-

HFA Advantage Plus & HFA Preferred Plus Forgivable Second Mortgages: Provide 3%, 4%, or 5% of the loan amount for down payment and closing costs, forgivable after five years if certain conditions are met.

Ready to Get Started?

The journey to homeownership doesn’t have to be intimidating. Whether you’re exploring conventional, FHA, or VA loans, I’m here to guide you through the process and help you find the right mortgage option for your needs.

Ready to take the next step? Visit my online application to start your pre-approval process today!

https://clearmortgage.com/rafael-santos/

If you have any questions about your specific situation, schedule a consultation. Let’s discuss the best loan option for you!

Categories

Recent Posts

GET MORE INFORMATION

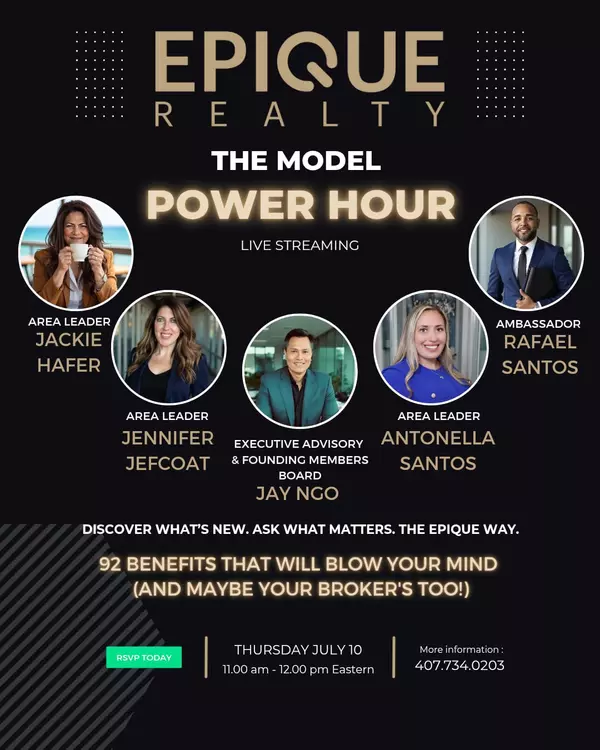

Realtor Area Leader & Licensed Loan Officer | License ID: 3424579

+1(407) 734-0203 | santos@epique.me