Don’t Pull the Plug! The Bills You Must Keep Paying When Selling Your Central Florida Home

Selling your home can feel like you’re balancing on a tightrope — prepping the house, staging for showings, negotiating with buyers, and then there’s the bills. Wait, bills? Yep — just because your home is for sale doesn’t mean all your financial responsibilities magically disappear.

In fact, stopping payments too soon can sabotage your sale, raise red flags for buyers, or even cause legal and financial headaches. So if you’re listing your home in Orlando, Winter Park, Kissimmee, or anywhere across sunny Central Florida, here’s your must-read guide on what bills you should absolutely keep paying during the selling process.

💡 1. Mortgage Payments — Still Mandatory

Even if your house is on the market, the bank still expects their monthly check. Missing mortgage payments can not only tank your credit score but also cause your home sale to collapse.

If you’re behind, let your real estate agent know. They may be able to help you navigate short sale options or discuss payment deferral programs. But never just stop paying — your listing could turn into a foreclosure faster than you think.

💧 2. Utilities — Keep the Lights (and AC!) On

You might not be living in the home, but it still needs to shine — literally. Imagine a buyer walking into a hot, dark, stuffy house in the middle of a Florida summer. Not a great first impression.

Here’s what you should keep active:

-

Electricity

-

Water

-

Sewer

-

Gas (if applicable)

A climate-controlled, well-lit home feels inviting and shows better. Plus, inspectors and appraisers will need the utilities on to do their jobs properly.

🧹 3. HOA Fees — Don’t Let Your Neighborhood Turn on You

If your home is in a community with a homeowners association (HOA), don’t skip those dues. Falling behind on HOA payments can lead to liens on your property, making it harder (or impossible) to close the sale.

Some associations even impose fines that compound quickly. Stay current and in good standing — buyers often ask for HOA documentation during the offer stage.

🛡️ 4. Home Insurance — Don’t Drop Coverage Just Yet

Your homeowner’s insurance should stay active until the day the sale closes. Why? Because things can (and do) go wrong.

If a storm hits, a pipe bursts, or there’s a break-in, you’ll want to be covered. Plus, many lenders require active coverage until the transaction is finalized. Dropping it early could delay or derail the sale.

Pro tip: Once the home is vacant, notify your insurer. You may need to adjust your policy to a “vacant home” plan to stay fully protected.

🌐 5. Internet & Cable — Optional, But Strategic

Not strictly necessary, but keeping your internet running can be a smart move if:

-

You’re using smart home tech (like a Ring camera, smart thermostat, or alarm system).

-

You’re allowing remote showings via virtual tours or video walkthroughs.

-

Your stager uses music or lighting setups controlled remotely.

Plus, agents may use Wi-Fi to run presentations or host virtual open houses, especially in tech-savvy Central Florida markets.

💰 6. Property Taxes — Don’t Fall Behind

Property taxes are typically prorated and handled at closing, but it’s critical to stay on top of deadlines. If you owe back taxes, the title company may require payment before closing, and that can create last-minute delays.

Check with your real estate agent or a local title company to see where you stand. In Florida, property taxes are due in March for the previous calendar year, with discounts for early payments starting in November.

🧾 7. Maintenance & Lawn Care — Keep Curb Appeal Alive

You might not think of lawn care as a “bill,” but outsourcing it while your home is listed can be one of the smartest investments you make. Buyers notice things like:

-

Overgrown grass

-

Dirty driveways

-

Wilting plants

-

Unkempt landscaping

In the Central Florida climate, it doesn’t take long for things to look rough. Budget for bi-weekly lawn service, occasional pool maintenance (if you have one), and general upkeep to keep your home looking its best.

🚨 Final Thoughts: Don’t Risk the Deal

Trying to save a few bucks by cutting off services or skipping payments can cost you thousands in a lost sale. Instead, work with your real estate agent to plan a smart exit strategy that keeps your home show-ready, financially stable, and buyer-friendly.

Selling in Central Florida? Whether you’re in Orlando, Altamonte Springs, or Clermont, staying on top of your bills can mean the difference between a smooth closing and a sale gone sideways.

📣 Ready to List Your Central Florida Home?

If you're thinking about selling — or just want expert advice on how to prep your home the right way — reach out today!

Let’s turn your “For Sale” sign into a “Sold” sign — without missing a single payment in the process.

Categories

Recent Posts

GET MORE INFORMATION

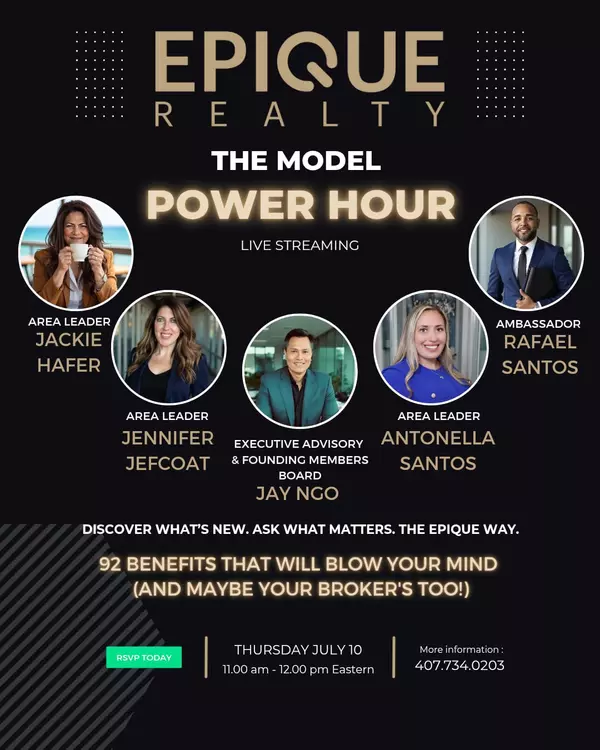

Realtor Area Leader & Licensed Loan Officer | License ID: 3424579

+1(407) 734-0203 | santos@epique.me