Jumbo Loans Explained: What You Need to Know About High-Value Home Financing

In today’s competitive real estate market, luxury properties and high-cost housing markets often require financing beyond conventional loan limits. This is where jumbo loans come into play. As a real estate agent, understanding jumbo loans can help you better serve high-net-worth buyers and sellers. Here’s what you need to know about these specialized mortgage products.

What Is a Jumbo Loan?

A jumbo loan is a mortgage that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). These loans are too large to be purchased by Fannie Mae or Freddie Mac, meaning they are not backed by government-sponsored enterprises (GSEs). As a result, jumbo loans typically come with stricter qualification requirements.

For 2025, the conforming loan limit for most of the U.S. is $806,500 for a single-family home. In high-cost areas like California, New York, and parts of Florida, the limit can go up to $1,209,750. Any loan exceeding these amounts is considered a jumbo loan.

Key Features of Jumbo Loans

✅ Higher Loan Amounts: Jumbo loans allow buyers to finance luxury homes, investment properties, or real estate in expensive markets.

✅ Stricter Credit Requirements: Most lenders require a credit score of 700 or higher to qualify for a jumbo loan.

✅ Larger Down Payments: While conventional loans may require as little as 3-5% down, jumbo loans often require 10-20% down.

✅ Competitive Interest Rates: Although jumbo loans were historically known for higher rates, today’s market often offers rates comparable to or slightly higher than conventional loans.

✅ More In-Depth Underwriting: Since these loans carry higher risk, lenders require extensive income documentation, lower debt-to-income (DTI) ratios, and larger cash reserves (often 6-12 months of mortgage payments).

Jumbo Loan Qualification Requirements

To help your clients prepare for a jumbo loan, they should expect to meet these key criteria:

📌 Strong Credit Score: Most lenders require at least 700-740+.

📌 Low Debt-to-Income Ratio: A DTI below 43% is typically required, though some lenders may allow higher with compensating factors.

📌 Substantial Cash Reserves: Many lenders require proof of 6-12 months of mortgage payments in liquid assets.📌 Consistent Income Documentation: W-2 earners need stable job history, while self-employed borrowers must provide 2 years of tax returns and financial statements.

📌 Larger Down Payment: 10-20% is common, though some lenders may allow as low as 5% for strong applicants.

Pros and Cons of Jumbo Loans

✅ Pros:✔️ Enables buyers to purchase high-value homes✔️ No loan limits, allowing more flexibility✔️ Interest rates are more competitive than in the past✔️ Can be used for primary residences, second homes, and investment properties

❌ Cons:⚠️ Stricter qualification requirements⚠️ Larger down payment and reserve funds needed⚠️ More detailed underwriting process⚠️ Potentially higher interest rates and fees

How Real Estate Agents Can Help Clients with Jumbo Loans

As a real estate agent, you play a crucial role in helping buyers navigate jumbo loan financing. Here’s how:

🔹 Educate Buyers Early: Inform clients about jumbo loan requirements upfront to avoid surprises later.🔹 Connect Buyers with a Trusted Loan Officer: Working with a knowledgeable lender who specializes in jumbo loans can simplify the process.🔹 Advise on Strong Financial Profiles: Encourage buyers to improve their credit score, lower their DTI, and increase cash reserves before applying.🔹 Understand Market Trends: Luxury and high-end markets can fluctuate, so staying informed on jumbo loan rates and underwriting trends is essential.

Final Thoughts

Jumbo loans open doors to luxury homeownership and investment opportunities, but they come with additional requirements. By understanding how jumbo loans work, real estate agents can better guide their clients through the homebuying process and position themselves as knowledgeable experts in high-value real estate markets.

Would you like a deeper dive into jumbo loan strategies for investors or a breakdown of jumbo loan alternatives? Let me know in the comments!

Apply for a jumbo loan today: https://clearmortgage.com/rafael-santos/

Categories

Recent Posts

How to Start Investing in Rental Properties in Central Florida: A Complete Guide for Volusia County & Deltona

The Ultimate Relocation Guide to Central Florida: Why Volusia County & Deltona Are Calling You Home

Living in Deltona: Top Schools, Beautiful Parks, and Family-Friendly Attractions in Central Florida

Staging Tips to Help You Sell Faster in Central Florida’s Market

Avoid These Common Home Selling Mistakes in Volusia County (And Sell Faster!)

How Much is My Home Worth in Deltona? Your 2025 Central Florida Market Update

How to Prepare Your Central Florida Home for a Successful Sale

How Self-Employed Buyers Can Qualify for a Mortgage in Florida

Why Retirees Are Flocking to Volusia County — And Where They’re Buying Homes

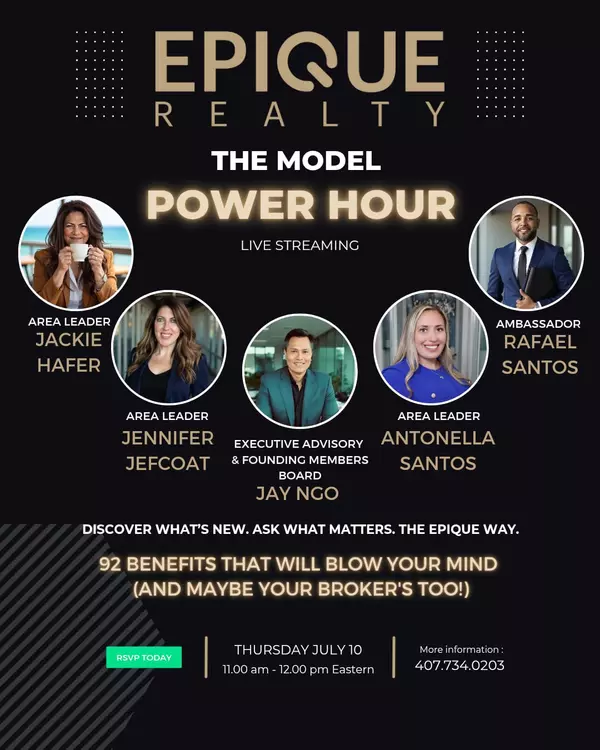

Calling All Agents: This Is More Than Just a Zoom Call — It’s the Epique Way to Elevate Your Career.

GET MORE INFORMATION

Antonella & Rafael Santos

Realtor Area Leader & Licensed Loan Officer | License ID: 3424579

+1(407) 734-0203 | santos@epique.me